Quick Menu

PSP setup

This section provides an overview of the PSP setup process required to enable communication between your PSP and Accounting as a Service. The primary goal is to connect the two systems so that the capture and refund process can take place by Accounting as a Service

Like for the bank account, each business code (legal entity) must have its own accounts on PSP-side and the setup will need to include access to each account.

Adyen

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and Adyen for captures and/or refunds:

- Username | WebService Username from Adyen

- Password | Password from WebService Username

- MerchantAccount | Adyen merchant account

To ensure that all processes work, we need a read-only user for the backend of Adyen. The names of the users will be provided by the Onboarding Manager.

Settlement files

Usually Adyen provides the settlement files in a CSV-Format that can be configured by you in the administration-pannel.

The following settings would help in the test-process:

- Generation of settlement-file next day

- The settlement file should be generated automatically

The file will be provided on in an sFTP folder that you get the user-credentials for. Accounting as a Service needs to get a user for this folder as well (Test + PROD).

Accounting as a Service will collect the settlement files from the Adyen sFTP server to process it in the system.

Webhook Setup

Adyen processes the request asynchronously. Therefore the final status of the request will not be provided as response to the request. Instead, Adyen provides webhooks to update the status of the request later on.

- Select the appropriate Merchant (choose Company level) from the Adyen top left menu.

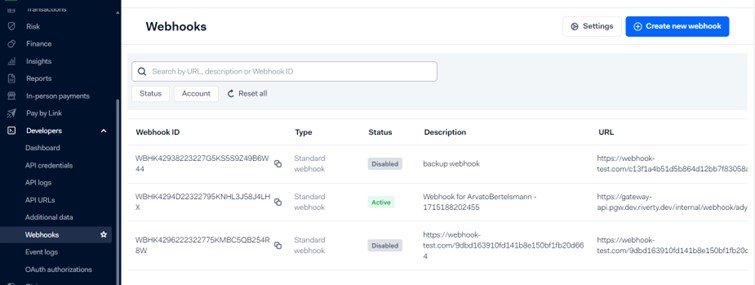

- From the menu, navigate to Developers | Webhooks, and then click on Create new webhook

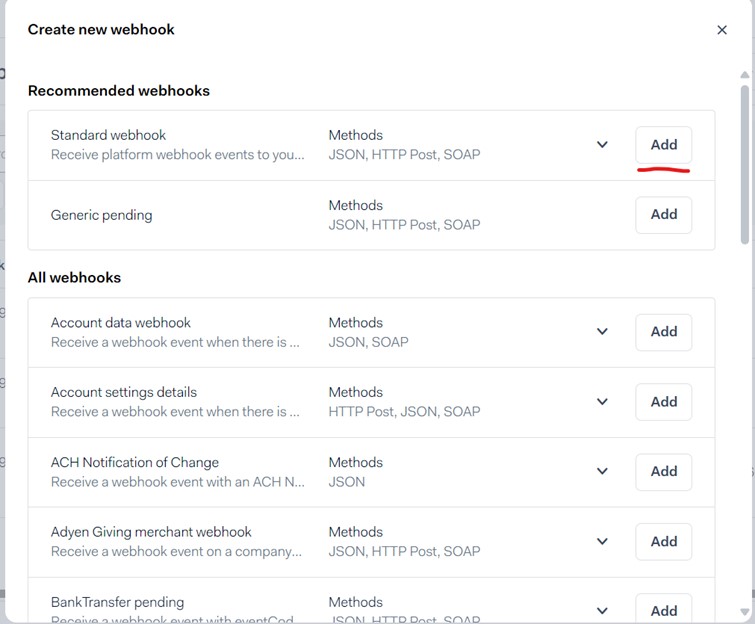

- Click on the Add button for Standard Webhooks

- Fill in the required information

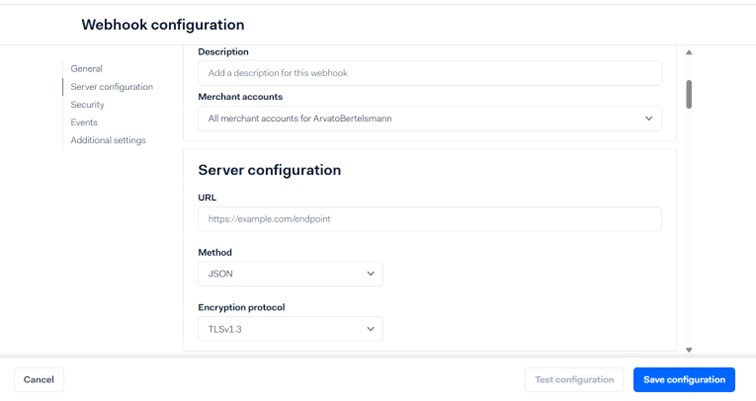

- Add a value for the Description field.

- Recheck the target merchant in the Merchant Accounts dropdown

- Fill in the URL with the specific environment PayGate webhook URL.

- The end-point for the webhook need to be configured, depending on the environment:

- UAT-environment: https://gateway-api.pgw.test.riverty.dev/internal/webhook/adyen/generic

- PROD-environment: https://gateway-api.pgw.live.riverty.io/internal/webhook/adyen/generic

- Set Method as JSON

- Set Encryption Protocol as TLSv1.3

- Select Generate new key and click on Generate for the HMAC

- Copy the generated HMAC Key and send it to the Onboardig Manager

- Click on Save Configuration

- Test webhook (optional) Note: the HMAC key must be already setup in PayGate in order for the test to be successful. Click on the Test button and expect a successful result.

Stripe

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and Stripe for captures and/or refunds:

- api.key

- hmax.key when the webhook listener was registered

To ensure that all processes work, we need a read-only user for the backend of Stripe. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

RivertyPay

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and RivertyPay for captures and/or refunds:

- authorization.key

To ensure that all processes work, we need a read-only user for the backend of Worldpay. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

To receive information on declines, the webhook "refused" needs to be set up.

For refunds, the interface works synchronously and thereby no webhook has to be set up.

Worldpay

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and Worldpay for captures and/or refunds:

- UserName

- Password

To ensure that all processes work, we need a read-only user for the backend of Worldpay. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

To receive information on declines, the webhook "refused" needs to be set up.

For refunds, the interface works synchronously and thereby no webhook has to be set up.

Klarna

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and Klarna for captures and/or refunds:

- Merchant ID

- Username

- Password

To ensure that all processes work, we need a read-only user for the backend of Klarna. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

The Klarna interfaces works synchronously and thereby no webhook has to be set up.

First Data

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and First Data for captures and/or refunds:

- api.key

- secret.key

- merchant.id

To ensure that all processes work, we need a read-only user for the backend of First Data. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

The First Data interfaces works synchronously and thereby no webhook has to be set up.

AmazonPay

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and AmazonPay for captures and/or refunds:

- MerchantId

- Mws.Auth.Token

To ensure that all processes work, we need a read-only user for the backend of AmazonPay. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

PayPal

Credentials

The following information is needed from you to set up the connection between the Accounting as a Service and the PSP for captures and/or refunds:

- Client.Id

- Client.Secret

- MerchantId

To ensure that all processes work, we need a read-only user for the backend of PayPal. The names of the users will be provided by the Onboarding Manager.

Settlement files

Webhook Setup

The following events need to be configured for Accounting as a Service:

- Payment.Capture.Declined

- Payment.Capture.Reversed

- Payment.Capture.Completed