Entity-Relationship Model

This section provides an overview of the entity-relationship model within Accounting as a Service, detailing how various entities interact and are structured. Understanding these relationships is crucial for integrating and managing data effectively within the system.

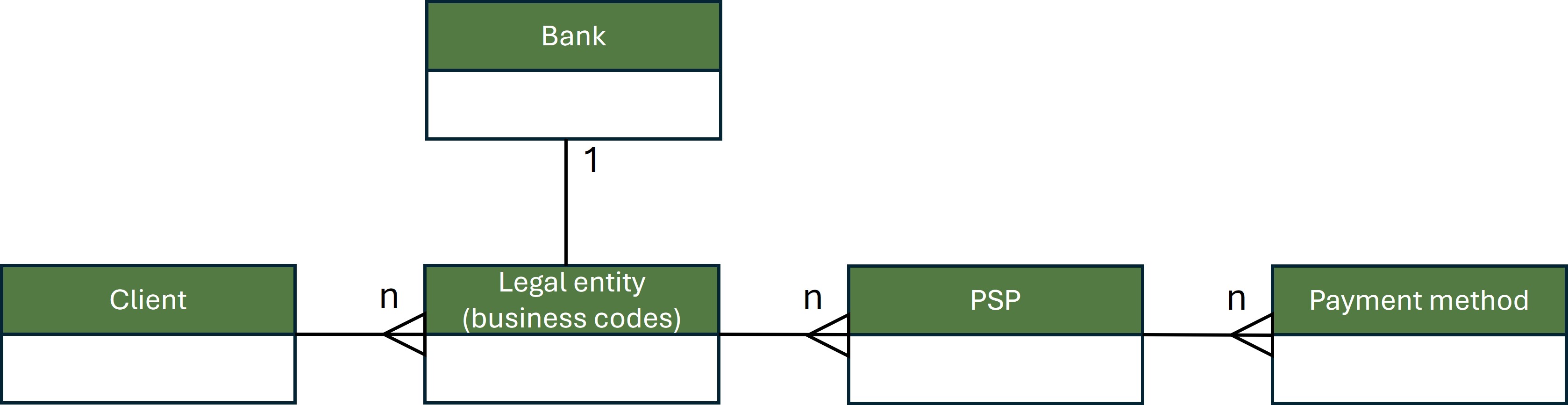

Client and Legal Entity Structure

-

Client to Legal Entities: A single client can have multiple legal entities, each represented as separate business codes within Accounting as a Service. This structure allows for distinct financial and operational tracking across different legal units of the same client.

-

Legal Entity to Bank and PSPs:

- Bank Setup: Each legal entity is linked to exactly one bank, which handles all financial transactions related to that entity, such as incoming payments, direct debits, and refunds.

- PSPs (Payment Service Providers): A legal entity can be connected to multiple PSPs to support various payment methods. These PSPs manage the processing of payments and must be configured correctly within the system.

-

Month-End Reporting: For each business code (legal entity), a single month-end report will be generated, capturing all relevant financial transactions and summaries for that period.

Data Structure Within Accounting as a Service

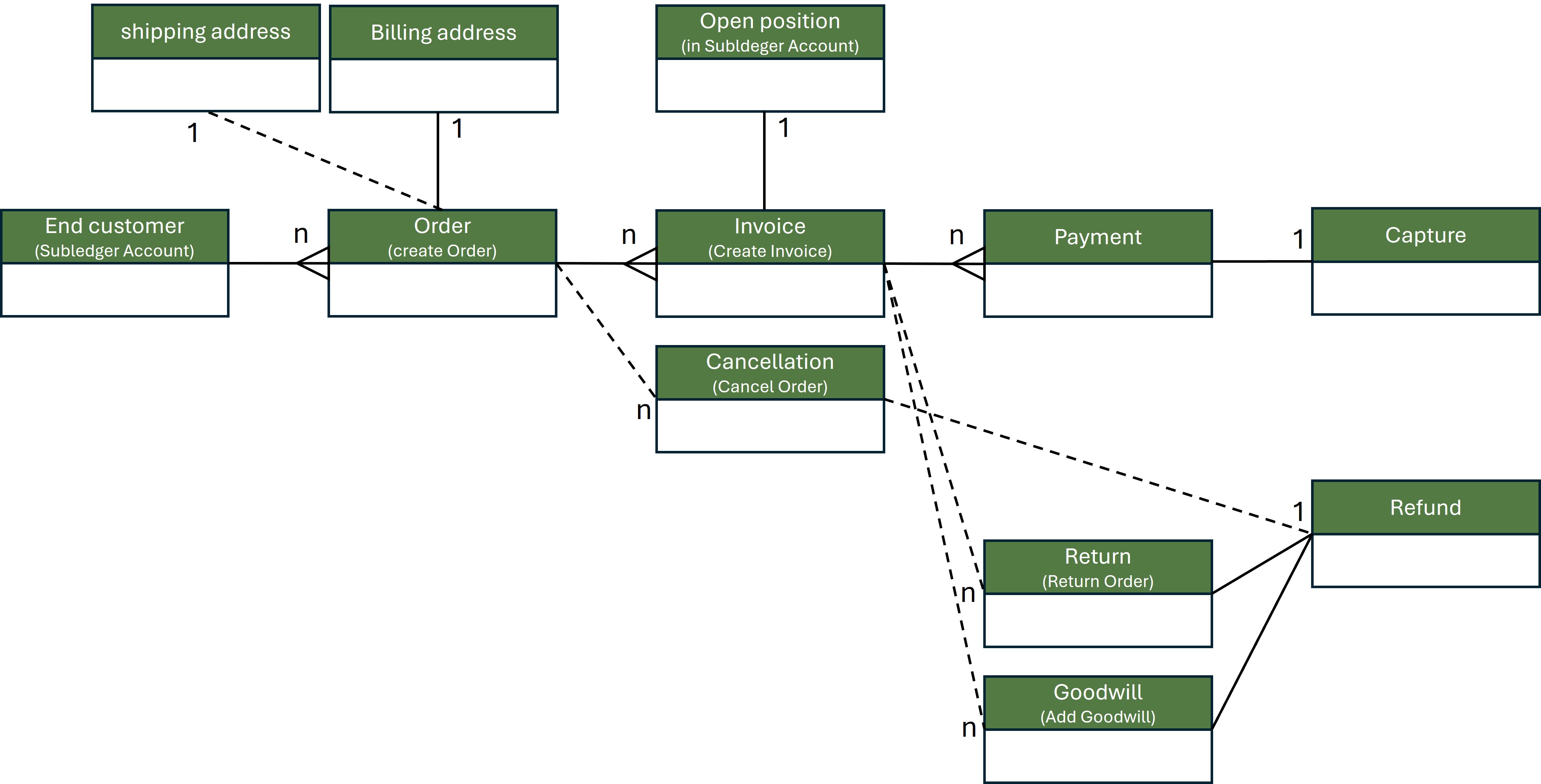

End-Customer to Orders:

- An end-customer can place multiple orders. Each order represents a distinct transaction initiated by the customer.

Order to Shipments/Invoices:

- Each order may result in one or more shipments, each generating a corresponding invoice. This flexibility allows for partial shipments and invoicing based on order fulfillment. Please note: only complete line items can be shipped/invoiced. A partial line item shipment is not possible. This means, if you provide an order with 1 line item and the quantity of 3, you can only invoice the entire line item (all three products together). If you want to be more flexible, you need to split up the line item into three positions. However you need to know that in this case you need to remember, which line item was in which position as you will be asked to provide the exact line item number for Returns or Goodwills.

Invoice to Payment:

- Single Invoice Payments: Typically, each invoice will have exactly one payment associated with it, ensuring a direct match of payment to billing.

- Grouped Payments: Customers may also make a single payment covering multiple invoices, particularly when managing grouped or consolidated payments.

Billing and Shipping Addresses:

- Each order includes one billing address and may have one optional shipping address, which are also reflected in subsequent invoices. The correct addresses are essential for tax calculations and compliance.

Payments and Methods:

- End-customers can use different bank accounts or payment methods to settle their invoices, providing flexibility in how they manage their payments.

Subledger Accounting:

- Each invoice generates one open position in the end-customer's account within the subledger. This entry tracks the outstanding amount until it is fully settled by the customer.