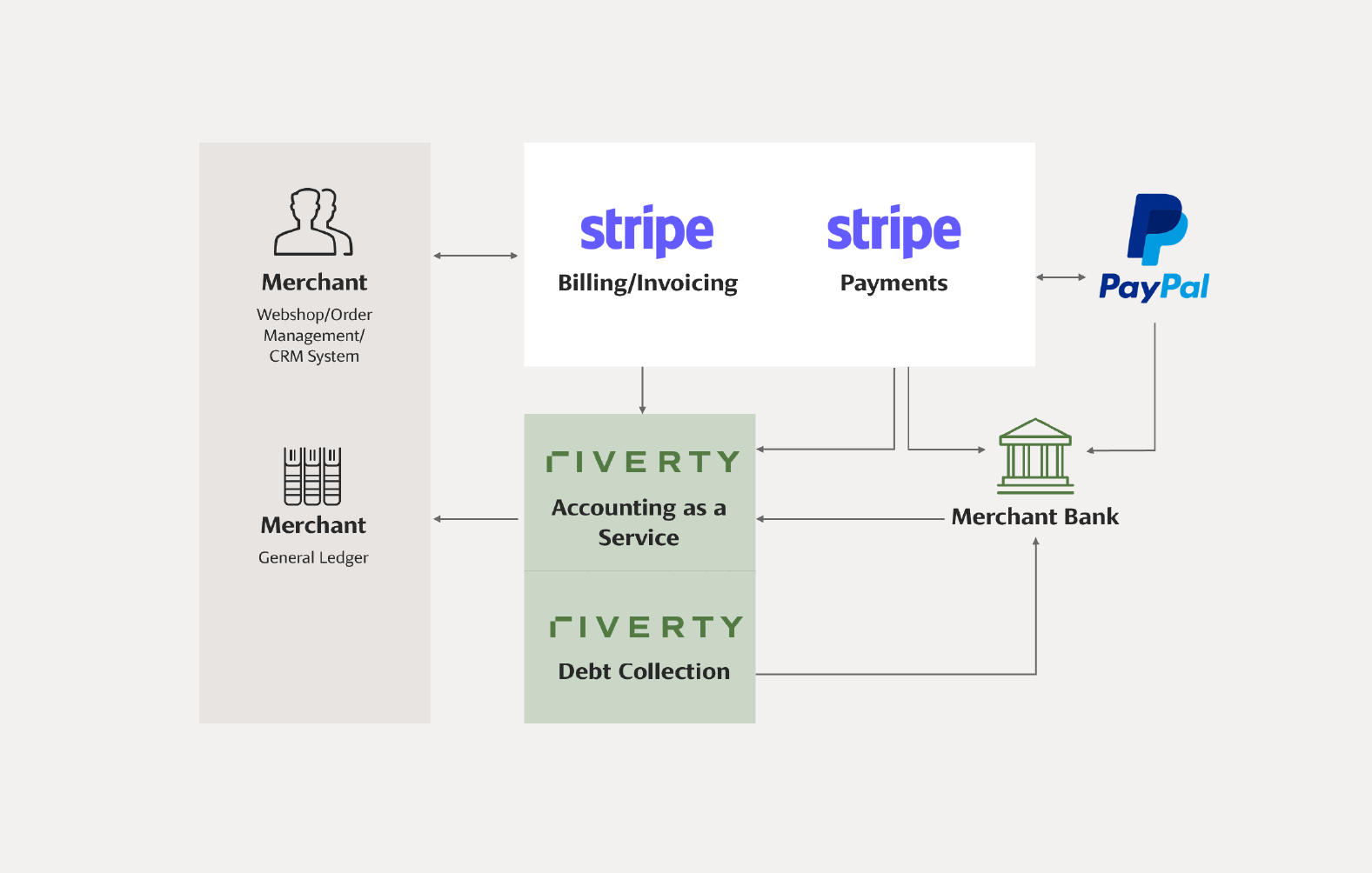

Stripe-Connector

You can use the Stripe Connector to seamlessly integrate Stripe with Accounting as a Service. This connection eliminates the need for direct integration with Accounting as a Service by allowing the system to listen to key events from Stripe and book revenues, taxes, and refunds accordingly.

Benefits:

- Reduced integration efforts as no additional setup is required on your side to connect to Accounting as a Service.

- Stripe handles all invoicing and payment capture processes.

- You can still take advantage of features like dunning, end-customer communication, and notifications via Accounting as a Service.

How the Stripe Connector Works

The connector listens to the following key events from Stripe:

- invoice.finalized: Triggers the booking of the invoice.

- credit_note.created: Initiates booking for refunds, regardless of whether it is a goodwill or a return.

- reporting.report_type.updated: Accounting as a Service requests and processes settlement files.

Step-by-Step Guide: Invoice Process

- End-customer places an order on your website.

- Stripe generates the invoice and captures payment.

- Accounting as a Service listens to the event

invoice.finalizedand pulls relevant data from Stripe. - Accounting as a Service books the invoice (revenue, taxes, etc.).

- Stripe processes the payment and creates a settlement file

- Accounting as a Service listens to the event

reporting.report_type.updated, gets the settlement file and books the records accordingly. - Stripe transfers payments to your bank.

- Accounting as a Service receives the bank statement and books accordingly.

Step-by-Step Guide: Refund Process

- You issue a goodwill or process a return for the customer.

- Stripe processes the refund.

- Accounting as a Service listens to the event

credit_note.created and pulls the data from Stripe. - Accounting as a Service books the refund under a goodwill entry.

- Stripe processes the refund and creates the settlement file.

- Accounting as a Service listens to the event

reporting.report_type.updated, gets the settlement file and books the records accordingly.

Key Differences from Direct Integration

- Reduced Setup Effort: No need for direct integration with Accounting as a Service.

- No Payment Method Differentiation: Only one payment method, "Stripe Collected," will be communicated to Accounting as a Service.

- No Reporting on Payment Methods: Payment method reporting must be managed within Stripe.

- No Control Over Capture and Refund: These processes are handled by Stripe, not Accounting as a Service.

- Invoice Generation: Invoices are created by Stripe, not Accounting as a Service.

- Tax Configuration: Stripe handles tax settings (reduced, normal, or taxless), and Accounting as a Service uses this information for booking purposes.