Quick Menu

Stripe-Connector Setup

To connect Stripe with Accounting as a Service, you will need to configure webhooks and restricted API keys in Stripe. This setup will allow Accounting as a Service to listen to relevant events in Stripe and automatically handle booking, invoicing, and refunds.

Step-by-Step Setup Process

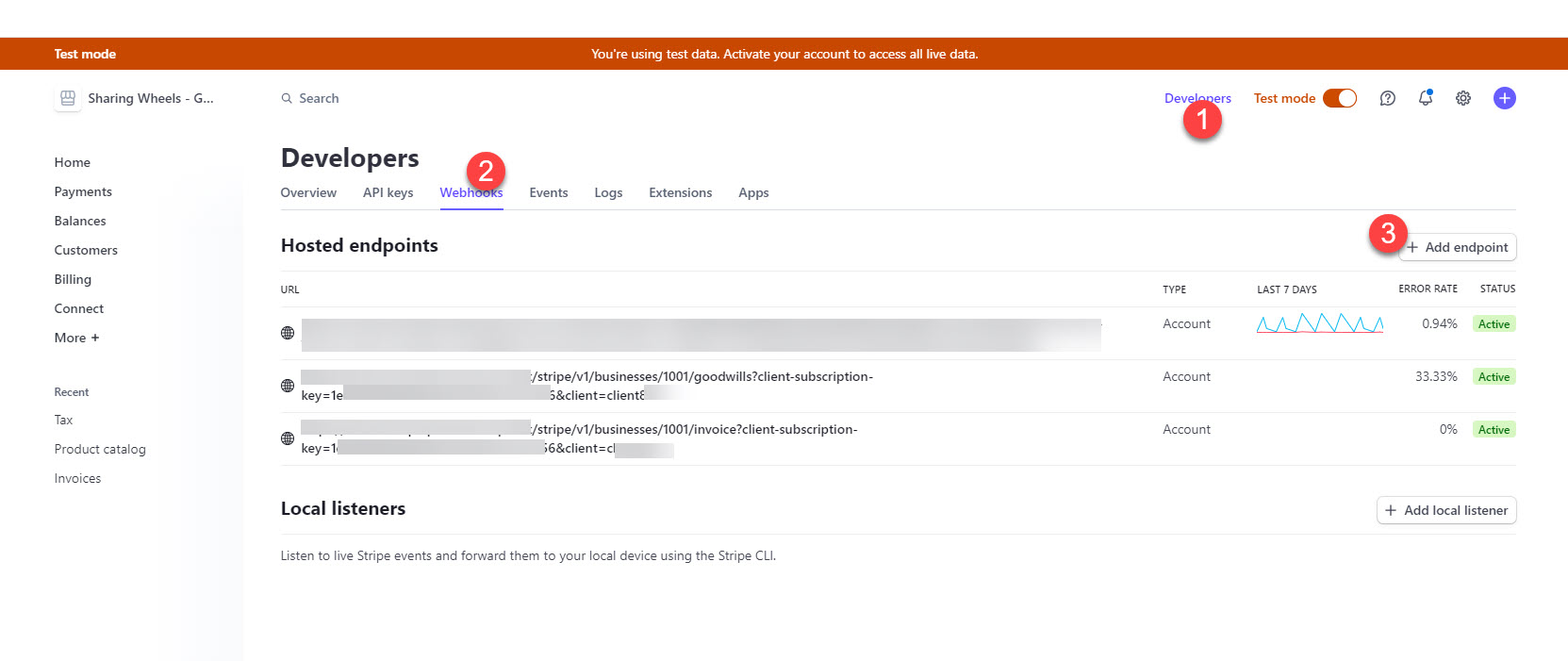

Set Up Webhooks for Accounting as a Service in Stripe

- Go to "Developers" > "Webhooks" in Stripe.

- Add the following events for both test and production environments:

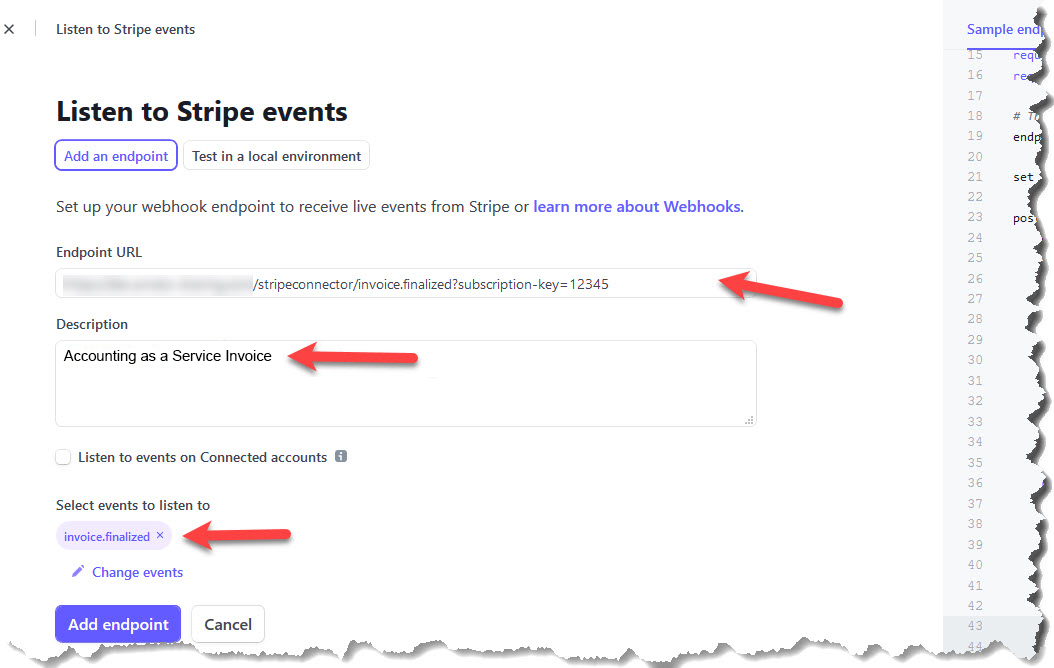

- invoice.finalized: Triggers booking of invoices.

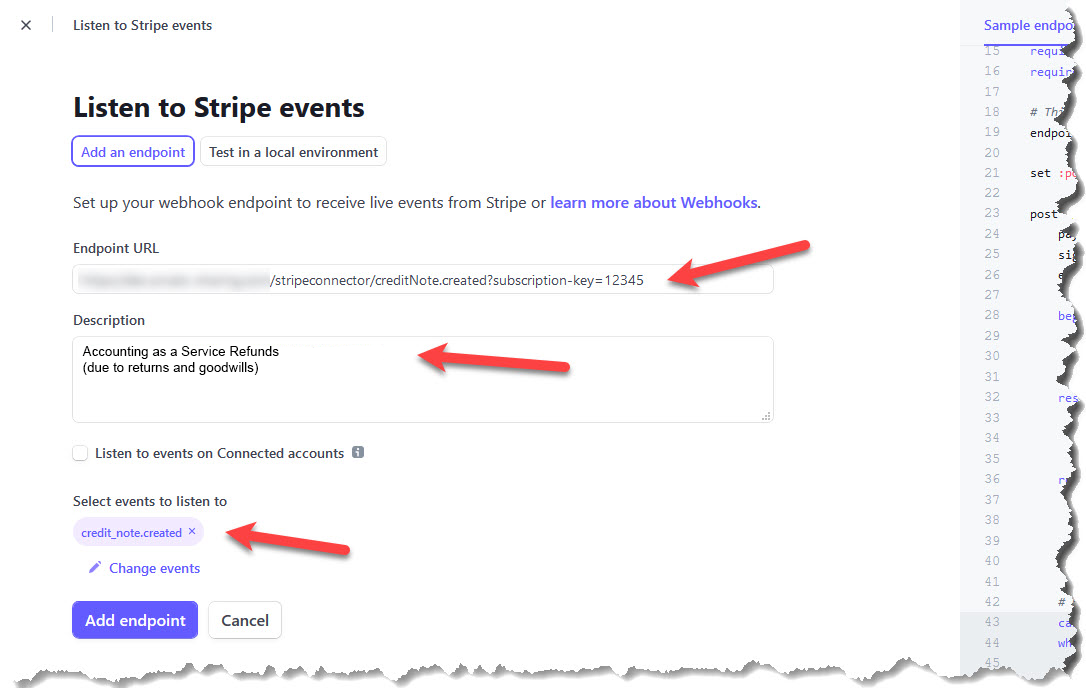

- credit_notes.created: Triggers booking of refunds.

- invoice.voided: Voids an invoice.

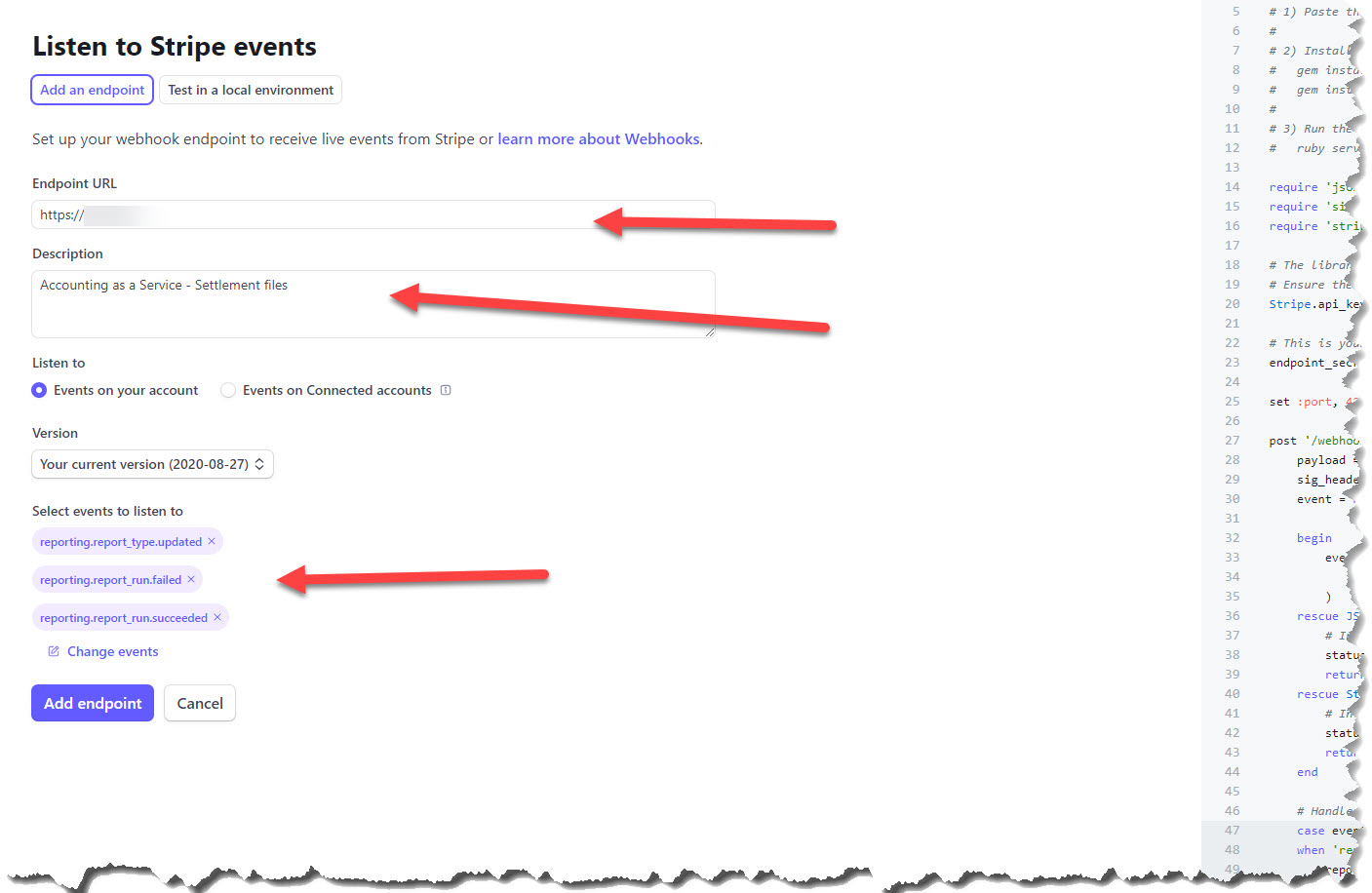

- reporting.report_type.updated, reporting.report_run.succeeded, reporting.report_run.failed: Triggers processing of settlement files.

- Use the URLs provided by the Accounting as a Service team for each webhook endpoint (Test and Production).

The final screen for invoices should look like this. If so, please add the endpoint URL:

The final screen for refunds/creditNotes should look like this.

The final screen for settlement-files should look like this.

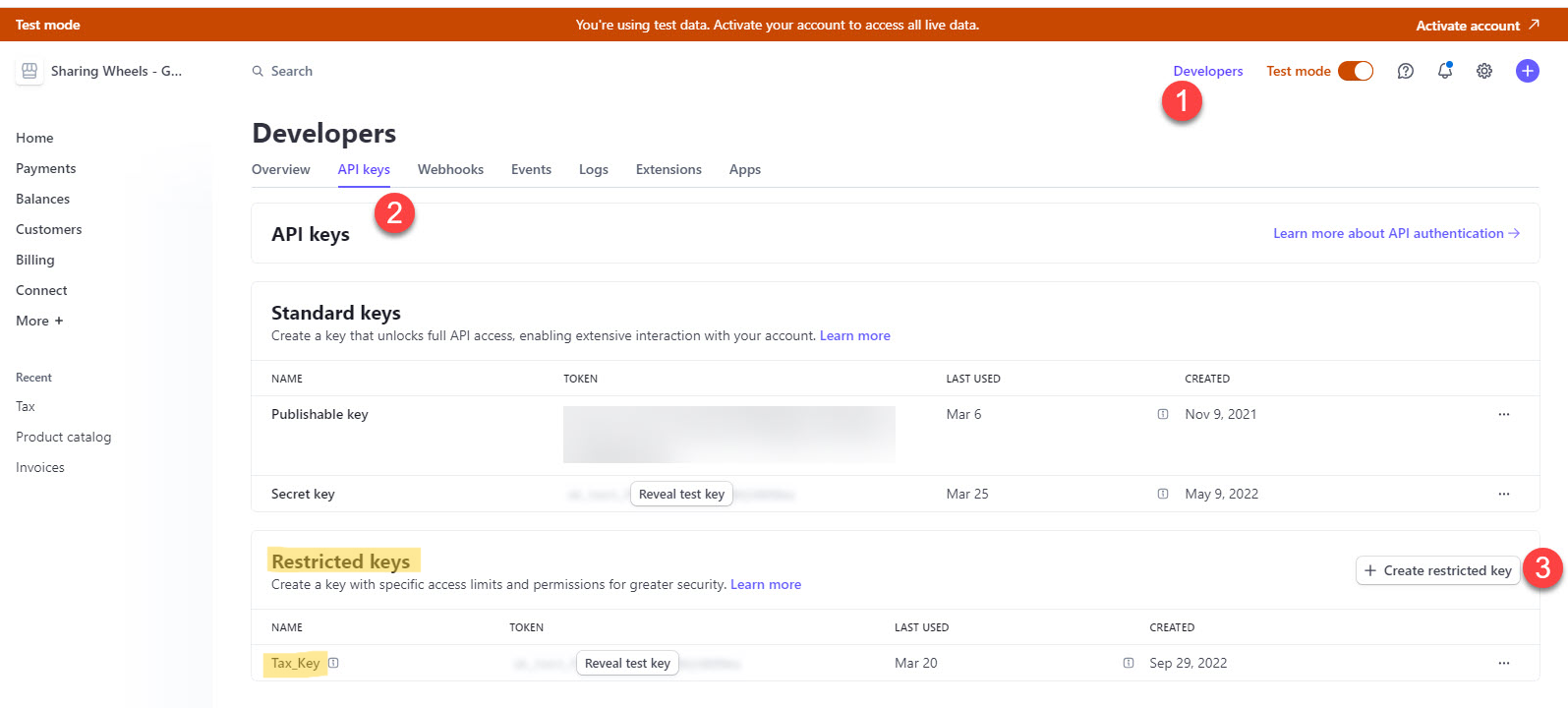

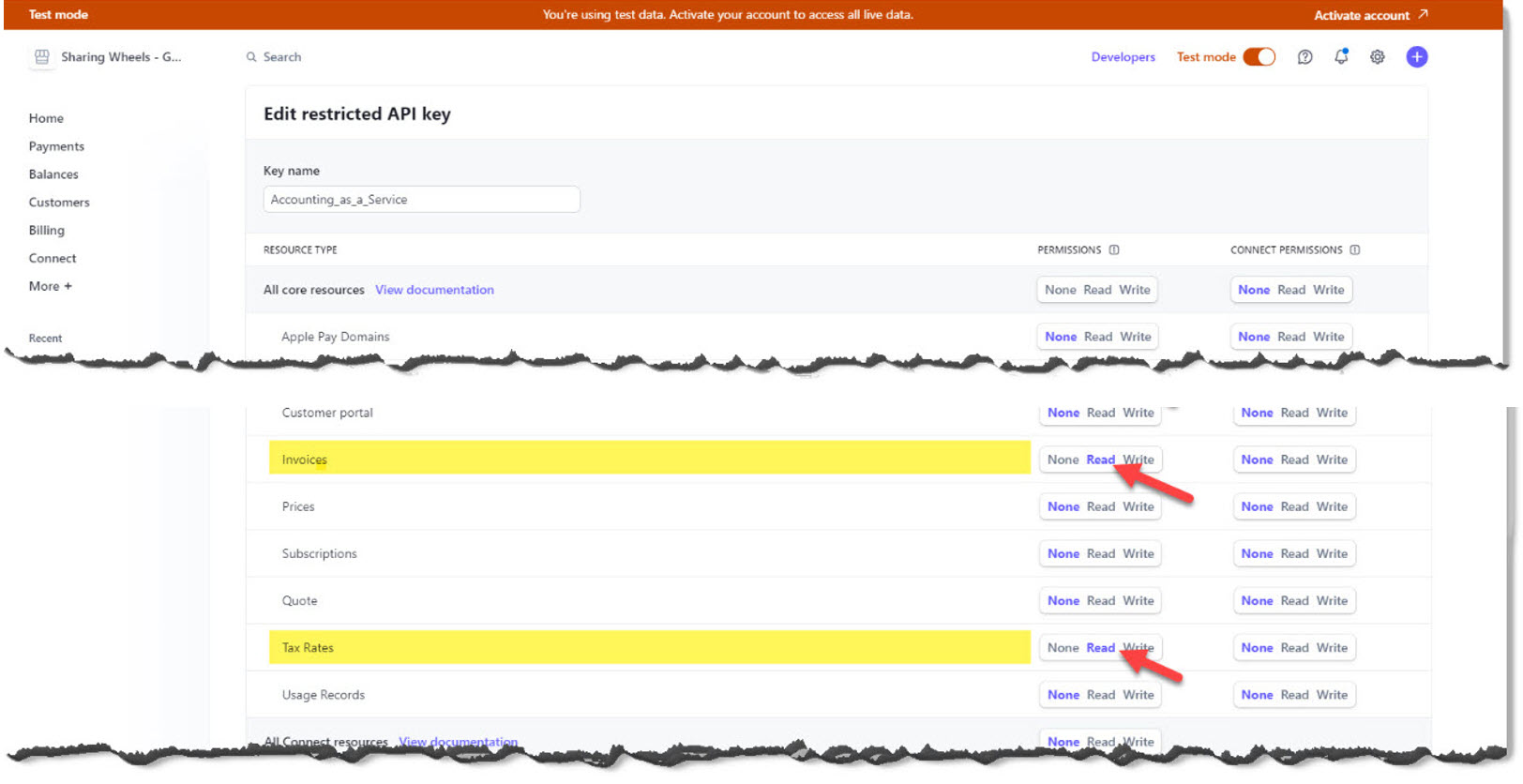

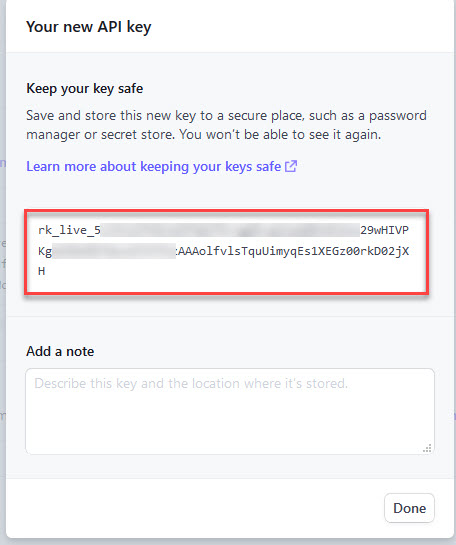

Create a Restricted API Key in Stripe

- Go to "Developers" > "API keys" in your Stripe dashboard.

- Create a restricted API key named

Riverty_keywith the following permissions:- Read: Events, Invoices, Tax Rates, Report Runs, Report Types.

- Write: Files (for settlement files).

- Once created, provide this key to the Accounting as a Service team for configuration.

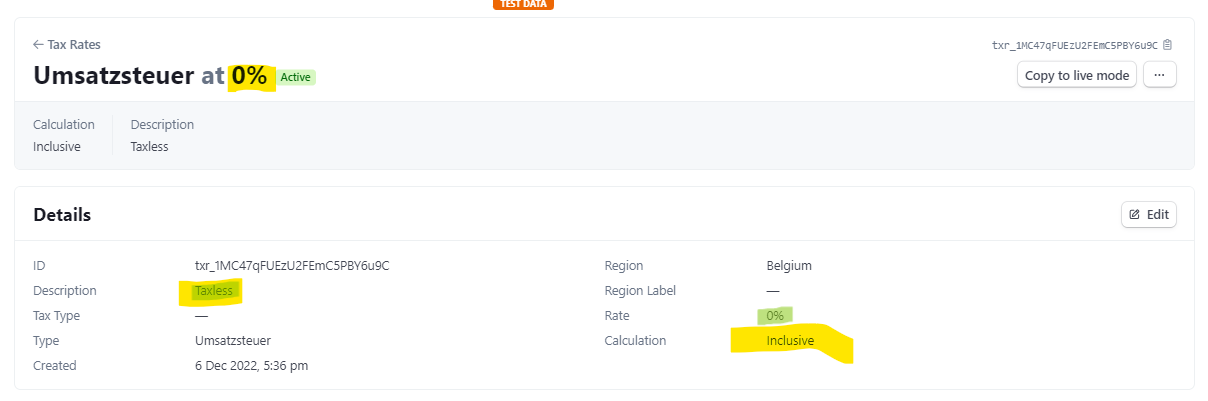

Set Up Taxes in Stripe

- Configure tax rates for your products in Stripe and assign a description for each tax category, such as "Taxless," "Reduced," or "Normal."

- This ensures that Accounting as a Service can accurately process the tax information for each invoice.

Managing Multiple Legal Entities

If you have multiple legal entities or stores, each one needs to have its own Stripe account.

For each entity:

- Repeat the webhook and API key setup process.

- Provide Accounting as a Service with the necessary store and legal entity details, including:

- Name of the store/legal entity.

- Country of the legal entity.

- Currency used.

Please note: if you want to extend your business to new country-stores / legal entities, Accounting as a Service needs to be set up in the same way. Therefore please contact us, so that we can set you up and generate a subscription key and URL for the new business.

Additional Information Required for Setup

To complete the Stripe connector setup with Accounting as a Service, you will need to provide:

- Contact details: So that we can communicate setup details with you.

- Contract details: A signed contract is required before we can begin the setup.

- Master data: Company information, such as legal entity names and contact info.

- Bank setup: You will need to provide EBICs credentials for Accounting as a Service to access bank statements.

- Notifications: Optional - you may register for Accounting as a Service notifications if needed.

Receiving Month-End Reports

To receive the month-end reporting for your general ledger, you will need to subscribe to the month-end notification, or alternatively, you can receive the reporting via email (CSV or XML format).